What If My Insurance Wants to Settle, but I Don’t Agree?

What to Do If Your Insurance Wants to Settle, but You Disagree

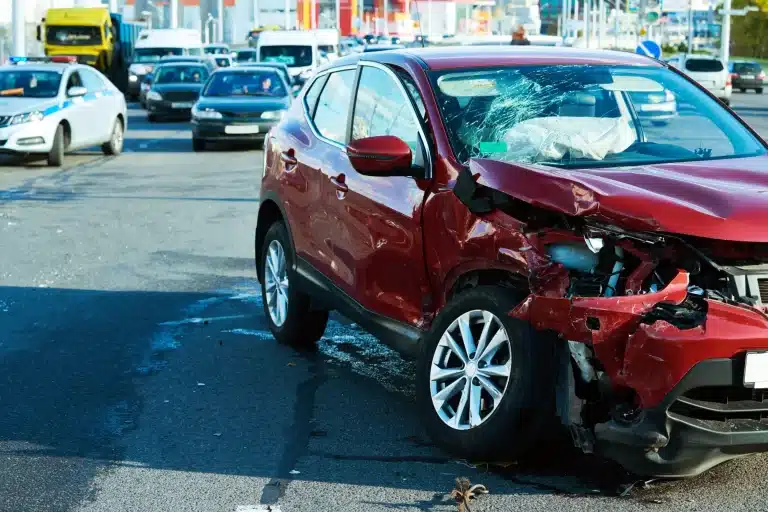

When you’re involved in a car accident in Florida, your insurance company may decide to settle the case—even if you believe you weren’t at fault. This can be frustrating, especially if you want to fight the claim. But do you have a say in the settlement? What are your legal options if your insurer proceeds against your wishes?

Understanding how Florida insurance laws work and your rights as a policyholder can help you make an informed decision.

Can My Insurance Company Settle Without My Consent?

In most car accident cases, your insurance provider has the right to settle a claim without requiring your approval. Florida operates under liability insurance laws, meaning your insurer is responsible for handling claims brought against you up to your policy limits. If they determine settling is in their best financial interest, they may proceed—even if you don’t agree.

However, there are exceptions depending on your policy type and specific circumstances.

When Insurance Companies Can Settle Without Consent

Most standard auto liability policies include a clause giving the insurer control over settlement decisions. This means they can settle even if you disagree.

Florida law also does not require insurance companies to get your approval before resolving a third-party claim (when someone sues you for damages). Insurers make settlement decisions based on factors like:

- The risk of losing in court

- The cost of legal defense

- Whether a settlement is cheaper than a trial

When You May Have a Say

In some cases, you can challenge your insurer’s decision, such as:

- If your policy has a consent-to-settle clause (common in professional liability policies but rare in standard auto policies)

- If the proposed settlement would exceed your policy limits and expose you to personal financial risk

- If the settlement could negatively impact your driving record, employment, or reputation

Why Does My Insurance Want to Settle If I Wasn’t at Fault?

Even if you are confident you didn’t cause the accident, your insurer may still choose to settle for several reasons:

- Avoiding litigation costs: Trials are expensive, and insurance companies aim to minimize expenses.

- Uncertain legal outcomes: Even if liability seems clear, juries can be unpredictable.

- Comparative negligence laws: Florida follows a modified comparative negligence rule, meaning you could still be held partially at fault. If you are found more than 50% responsible, you cannot recover damages (Florida Statutes §768.81).

- Policyholder protection: Settling may prevent a larger judgment that could exceed your policy limits, leaving you personally liable.

If you disagree with their assessment, you have options.

What Can You Do If You Don’t Want to Settle?

If you believe the settlement is unfair or unnecessary, consider the following steps:

1. Review Your Insurance Policy

Carefully read your policy terms. Look for language about your rights in settlement decisions, including whether you have a consent-to-settle clause or any protection against forced settlements.

2. Communicate with Your Insurance Adjuster

Express your concerns to your insurance company in writing. Request detailed reasoning for their decision and provide evidence (e.g., police reports, witness statements) supporting your case.

3. Request Independent Legal Counsel

Insurance companies prioritize their financial interests—not necessarily yours. If you feel your insurer is not acting in your best interest, consult a Florida personal injury defense attorney. You may have a legal basis to challenge the settlement.

A lawyer can assess whether your insurer is acting in bad faith, which could allow you to take legal action against them. Learn more about Florida car accident defense attorneys.

4. Challenge the Settlement Decision

If your insurer insists on settling, you may:

- File a complaint with the Florida Department of Financial Services

- Negotiate a different resolution, such as a settlement without admitting liability

- Pursue legal action against your insurer if they act in bad faith by not properly defending you

Florida has bad faith insurance laws (Florida Statutes §624.155) that allow policyholders to sue their insurance provider if they handle claims improperly.

Will a Settlement Affect You Personally?

A settlement could have long-term consequences, even if it doesn’t come out of your pocket. Consider:

- Insurance rate increases – Your premiums may rise after a settlement.

- Driving record impact – Settlements can sometimes be reported as an at-fault accident.

- Legal liability risks – If the claim exceeds your coverage, you could be personally sued for the remainder.

To avoid unnecessary financial risks, consult a Florida personal injury defense lawyer before agreeing to any settlement.

When to Get Legal Help

If your insurance company wants to settle and you strongly disagree, it’s best to seek legal representation. An attorney can:

- Determine if your insurance provider is acting in bad faith

- Negotiate on your behalf to prevent an unfair settlement

- Protect you from personal financial liability

- Help you understand your legal rights and options

For defense representation in a Florida car accident case, consider speaking with Florida civil lawsuit defense attorneys who can guide you through the process.

Defending Your Rights Statewide

Disagreeing with your insurance company’s decision to settle a claim can feel frustrating and overwhelming. However, you are not without options. Whether you believe the accident was not your fault or you are concerned about the impact a settlement could have on your finances, driving record, or future legal liability, it’s important to take action before it’s too late.

Our firm, based in Orlando, represents clients across Florida, including Miami, Tampa, Jacksonville, Pensacola, and beyond. We understand the complexities of insurance settlements and defense strategies, and we are prepared to fight for your best interests. We are committed to defending Florida residents and businesses statewide against unjust settlements and claims. Let us help you navigate this process with confidence and peace of mind.