What is Insurance Subrogation?

What is Auto Insurance Subrogation?

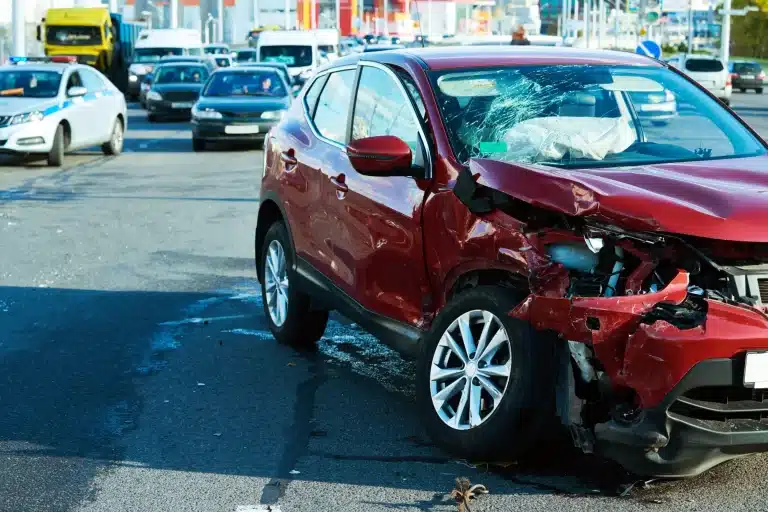

Insurance subrogation is when an insurance company tries to get back money they paid out to their customer for a claim by going after the person or company responsible for the damage. Let’s say you have car insurance and you get into a car accident. Your insurance company pays for the damages to your car and your medical bills. If the accident was not your fault, your insurance company may try to get the money back from the other driver’s insurance company.

This is where subrogation comes in. Your insurance company will step into your shoes and try to recover the money they paid out on your behalf. They will investigate the accident and gather evidence to prove that the other driver was at fault.

If they are successful, they will receive a payment from the other driver’s insurance company to cover the costs of your claim. This process helps keep insurance premiums lower for everyone because the responsible party’s insurance company is paying for the damages instead of your insurance company.

What is Uninsured Motorist Subrogation?

Uninsured motorist subrogation is a type of subrogation that happens when you get into a car accident with someone who doesn’t have insurance. If you have uninsured motorist coverage on your own car insurance policy, your insurance company may pay for the damages and medical bills you incurred because of the accident.

After your insurance company pays for the damages, they may try to get the money back from the person who caused the accident. Since that person doesn’t have insurance, your insurance company would be going after them directly. This is where uninsured motorist subrogation comes in. Your insurance company will step into your shoes and try to recover the money they paid out on your behalf. They will investigate the accident and gather evidence to prove that the other driver was at fault.

If they are successful, they will receive a payment from the other driver to cover the costs of your claim. This process helps keep insurance premiums lower for everyone because the responsible party is paying for the damages instead of your insurance company.

Uninsured motorist subrogation can be complicated because the person who caused the accident may not have the money to pay for the damages. In this case, your insurance company may have to take legal action to recover the money.

It is important to note that uninsured motorist subrogation only applies if you have uninsured motorist coverage on your car insurance policy. If you do not have this coverage, your insurance company will not pay for the damages and you will have to pay for them yourself.

In short, uninsured motorist subrogation is a type of subrogation that happens when you get into a car accident with someone who doesn’t have insurance. If you have uninsured motorist coverage on your own car insurance policy, your insurance company may pay for the damages and medical bills you incurred because of the accident, and then try to get the money back from the person who caused the accident.

What Are Other Types of Insurance Subrogation?

Subrogation is not just for car accidents. It can happen in any situation where an insurance claim is paid out. For example, if your house is damaged by a storm and your insurance company pays for the repairs, they may try to recover the money from the company responsible for the damage, such as a utility company if a fallen power line caused the damage.

Subrogation can also happen in health insurance. If you are injured in an accident and your health insurance pays for your medical bills, they may try to recover the money from the person or company responsible for the accident.

In some cases, subrogation can be complicated. If multiple insurance companies are involved, they may have to work together to determine who is responsible for paying the claim. For example, if you are in a car accident and the other driver is at fault, but they are driving a rental car, the rental car company’s insurance may be responsible for paying the claim. Your insurance company may have to work with the rental car company’s insurance company to recover the money.

It is important to note that subrogation only applies to claims that are paid out by your insurance company. If you receive compensation from the person responsible for the damage, your insurance company will not try to recover the money.

Subrogation can also have an impact on your settlement. If your insurance company is successful in recovering the money they paid out on your behalf, they will take a portion of the settlement as reimbursement for the money they paid out. This is known as subrogation reimbursement.

Why Hire a Subrogation Defense Attorney?

The benefit of hiring a subrogation defense lawyer is that they can help you if an insurance company is trying to recover money from you.

Let’s say you were in a car accident and the other driver’s insurance company paid for the damages. However, the insurance company believes that the accident was actually your fault and they want to get the money back from you. This is where a subrogation defense lawyer can help.

A subrogation defense lawyer can investigate the accident and gather evidence to show that you were not at fault. They can also negotiate with the insurance company to try to get them to drop the claim or reduce the amount they are asking for.

Having a subrogation defense lawyer on your side can be especially helpful if the amount of money being claimed is significant. A lawyer can make sure that your rights are protected and that you are not unfairly held responsible for damages that were not your fault.

The subrogation process usually starts with the matter being referred to some sort of collections agency. In these instances, we are able to provide pre-suit settlement representation and attempt to negotiate a resolution. If the collection agency is not successful in recovering any money, then they will refer the matter to an attorney who can file the lawsuit. If you have been served with a subrogation lawsuit, call our office today to speak with a Florida Subrogation Defense Attorneys. Our offices are centrally located in Orlando, FL, but we represent clients throughout the state of Florida.