Understanding Florida Car Insurance Coverages: A Comprehensive Guide

Florida Car Insurance: What’s Actually Covered

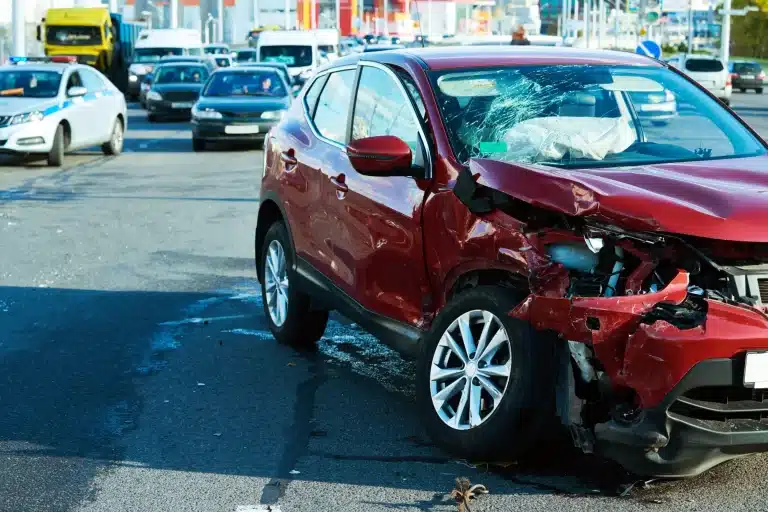

In Florida, where bustling roads and unforeseen incidents pose constant challenges, the guidance of a Florida car accident defense attorney becomes invaluable, especially when navigating the aftermath of a car crash. In the realm of personal injury defense, understanding car insurance coverage is paramount. When facing legal claims in Florida, knowing the nuances of these coverages can make all the difference in protecting your interests. Delving into the intricacies of car insurance and what each type of coverage entails is essential for anyone involved in a car accident or facing litigation as a result. Let’s explore the critical aspects of car insurance coverages:

1. Liability Coverage:

- Bodily Injury Liability: This essential coverage serves as a financial safety net if you’re found at fault in an accident, covering a broad spectrum of costs from the injured party’s medical expenses to legal fees. It’s not just about hospital stays or surgeries; this coverage extends to include rehabilitation expenses, necessary ongoing care costs, and compensation for lost wages, ensuring that the injured party’s financial burdens are alleviated as they recover.

- Property Damage Liability: Accidents can result in more than just vehicular damage. This coverage is designed to handle the costs associated with repairing or replacing any property you’ve damaged, from a neighbor’s mailbox to a city fence, or even structural damage to buildings. The aim is to restore the damaged property to its pre-accident condition, thereby providing peace of mind to both you and the property owner.

2. Personal Injury Protection (PIP):

- This crucial coverage is designed to ensure that, following an accident, you and your passengers’ immediate medical costs and lost wages are addressed, regardless of who was at fault. PIP coverage is particularly beneficial as it provides prompt financial assistance without the need to establish fault, which can be a time-consuming process. It covers a range of expenses including but not limited to medical and surgical treatment, ambulance fees, medication costs, rehabilitation services, and necessary dental and optometric treatment.

3. Uninsured/Underinsured Motorist Coverage (UM/UIM):

- Florida uninsured motorist coverage is vital for your financial protection in the event you’re involved in an accident with a driver who either lacks sufficient insurance or has none at all. UM/UIM coverage steps in to cover the gaps, providing you with peace of mind. It ensures that your medical expenses, including hospital visits, surgeries, and rehabilitation costs, are taken care of, even when the at-fault driver cannot pay. In essence, UM/UIM coverage shields you from the financial strain that can occur after accidents with underinsured or uninsured drivers, ensuring you and your finances are protected.

4. Comprehensive Coverage:

- Comprehensive coverage offers a safety net against types of damage not resulting from collisions. This includes scenarios such as theft, where your vehicle could be stolen and either damaged or not recovered. It also covers vandalism, ensuring that if your car is defaced or damaged maliciously, you’re not left footing the bill for repairs. Additionally, in the case of natural disasters—be it hurricanes, floods, fires, or hail—comprehensive coverage steps in to cover the repair or replacement costs of your vehicle. This type of coverage is particularly crucial in areas prone to extreme weather or high theft rates, providing peace of mind in a range of unforeseen circumstances.

5. Collision Coverage:

- This type of insurance is indispensable if your vehicle incurs damage from an accident, whether it’s with another vehicle, a building, a traffic fixture, or even if you hit a pothole. Collision coverage steps in to cover repair or replacement costs of your car, not concerning who was at fault for the damage. This can include anything from minor body work to major repairs, ensuring that your vehicle can be returned to a roadworthy condition as swiftly as possible. Having collision coverage provides a layer of financial security, allowing you to address vehicle damages head-on without the added stress of out-of-pocket expenses.

6. Medical Payments Coverage:

- Commonly known as “MedPay,” this coverage is an essential facet of your auto insurance policy, offering peace of mind by covering medical expenses associated with a car accident. This benefit applies no matter who is at fault and can cover a variety of costs, including hospital visits, surgeries, X-rays, and other necessary medical procedures following an accident. MedPay can be particularly beneficial as it works to fill in gaps left by your PIP coverage or health insurance, such as deductibles and co-pays, ensuring that you or your passengers receive the necessary medical attention without the immediate worry of out-of-pocket expenses.

Florida Civil Counsel, P.A.: Your Florida Car Accident Attorneys

As we conclude this comprehensive guide to navigating car insurance coverages, it’s clear that being well-informed and prepared is your best defense after a car accident. Understanding the various types of insurance can significantly impact the outcome of any claims and legal matters you might face. Should you find yourself in the midst of legal challenges following a car accident in Florida, do not hesitate to reach out to a knowledgeable Florida Car Accident Attorney. An experienced professional can provide invaluable guidance, helping you navigate the complexities of the law while ensuring your rights and interests are fully protected. Remember, in the volatile aftermath of an accident, having a dedicated advocate on your side can make all the difference.